By now, you may have already heard or read the news: after six years under the umbrella of Stanley Black & Decker, the Delta brand was recently sold to Chang Type Industrial Company Ltd. – a Taiwan-based manufacturing company of woodworking tools. The new company will be called Delta Power Equipment Corporation, and it will be headed by President and CEO Bryan Whiffen. Corporate headquarters will move one state east from Jackson, Tennessee, to Anderson, South Carolina. The deal is expected to close Feb. 4.

But, unlike some corporate changes of ownership, this does not spell gloom and doom for one of the most venerable brands in woodworking machinery. Rather, according to Whiffen, he hopes the exact opposite will be the case. It’s time to breathe new life into Delta’s stationary and benchtop power tool lines again. “My primary goal is to grow the company and bring it back to where it once was, as the tried-and-true ‘go-to’ brand for woodworkers.”

Whiffen takes the helm of Delta with significant tool experience already behind him. He has spent most of his professional career in the power tool industry and was formerly senior vice president for product development at Techtronic Industries North America (TTI). TTI, also located in Anderson, makes certain power tools for RIDGID, Ryobi, Milwaukee and Craftsman, among other brands. Whiffen will be joined by Norm MacDonald, who will serve as Delta’s executive vice president and chief operating officer. MacDonald left TTI two years ago after being with the company for six years. Both played significant roles in relaunching the Ryobi line, launching RIDGID power tools and making both brands more cost-effective and profitable.

Whiffen, who left TTI about five months ago, orchestrated the team to buy Delta after learning about Stanley Black & Decker’s interest in selling it last year. Whiffen says Stanley Black & Decker spent much of last year analyzing what seemed to be “duplication” in their product lines. Eventually the decision was made to divest Delta.

Delta’s new U.S. headquarters in Anderson will occupy a 56,000-sq.-ft. facility, built four years ago and previously owned by a boat manufacturer. About 6,000 sq. ft. will be allocated to offices, but the remaining 50,000 sq. ft. will be dedicated to manufacturing. Whiffen anticipates that about 50 percent of the space will go to metal fabrication. Warehousing and distribution will occur in another facility. Whiffen says the plant will be open by June 1, and he expects that the ribbon might actually be cut several months sooner, possibly by April 1.

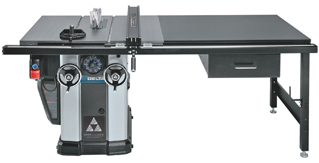

Manufacturing equipment currently used in the Jackson plant will move to Anderson, where Delta will continue to make Biesemeyer® fences, machine stands, radial arm saws and various other Delta tools, including the “new” Unisaw, which was launched several years ago. Castings and other components that are currently sourced stateside will continue to come from those vendors. While Delta’s new ownership is based in Taiwan, Whiffen does not plan to move more manufacturing overseas, although some tools will be sourced from outside the United States (as is now the case within the brand). According to Whiffen, “Everything that is currently made in Jackson will continue to be made in the United States.”

In this context, I was surprised to hear a potential shift in trend toward more American manufacturing in the future. Bryan says that as costs continue to rise in Asia, especially in terms of shipping heavy goods between continents, “it makes more and more sense for woodworking machinery to be made here in the States again.”

Currently, Delta plans to hire 40 employees over the next three to five years. Bryan says Black & Decker has provided a list of possible candidates currently working with the Delta brand, and some staff will likely be hired from the Anderson area as well.

Whiffen also commented that current Delta dealer networks and distribution channels will remain largely the same as they are now. In fact, Delta and Black & Decker are finalizing an agreement whereby Delta will honor all current tool warranties, but Black & Decker’s authorized and factory service centers will continue to repair Delta products. “We plan to use the same experts that have been servicing Delta customers well over the past six years.”

So, what should we expect to change in terms of Delta machinery?

Initially, Bryan says, not much. “To start out, we’re not going to change anything in the product lines too dramatically. We need to get to know our customers’ needs better and carefully evaluate our current tool lines…I will say that there are holes in the product line that need to be filled, and some existing products need to be freshened up. The number one request I’m hearing in my talks with dealers is that Delta needs to update its products and bring in more innovation. They say their Delta business has declined in the last five to six years because there hasn’t been enough new product activity.

The new Delta brand logo on tools and packaging will begin to happen gradually. “Otherwise, our initial outward changes to Delta tools should really go almost unnoticed by the woodworking equipment buying public,” Whiffen says.

Bryan revealed that Stanley Black & Decker currently has some new Delta products already in various stages of development, but he wouldn’t comment on those specifically beyond saying that “some things that have been tabled need to be pulled off the shelf to see if they’re still relevant to what we want to do with the brand going forward.”

Given Chang Type Industrial’s expertise in handheld power tools, I asked Whiffen if some of the potential new Delta offerings might be drills, routers, impact drivers and the like. He replied that, while handheld tools could happen eventually, there’s plenty of room in the realm of heavier machinery where Delta has done well in the past.

And, benchtop and stationary machinery is exactly where Delta’s sweet spot needs to be, according to Whiffen. It’s a segment of the market that the now independent Delta Power Equipment Corporation can more fully serve. At the close of our interview, I asked Bryan to explain what he sees as the principle advantage of Delta separating from the larger Stanley Black & Decker conglomerate:

“In a conglomerate situation, you have limited resources on the product development side. Everybody is trying to cut costs and reduce overhead, and that forces you to decide where to park development dollars. You can put development into a new table saw that might sell 25,000 units per year or a new cordless drill that will sell 250,000 in the same timeframe. Because of the shift to construction tools, which have been a high growth area for the tool companies over the last few years, the larger woodworking machine segment of the business has gotten the short shrift in new product development and innovation. However, I do feel Black & Decker turned an important corner with the redesigned Unisaw, and that’s something we hope to continue to build on in the future.

I think our new independent Delta Power Equipment Corporation, where all of our developmental resources will be focused on the woodworking tool category — be that a band saw, planer or other machines — will allow us to drive new product development into that category again…We are excited for this opportunity to invest in the great Delta brand so that we can bring high quality, innovative woodworking equipment to Delta’s loyal customers.”