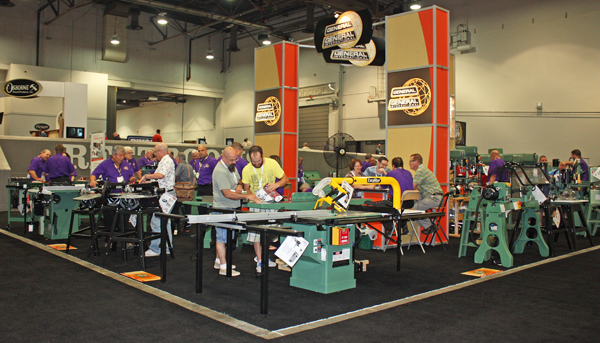

Just prior to this summer’s AWFS trade show in Las Vegas, Norman Frampton, marketing and communications manager of General International Woodworking Machinery, made an unusual announcement. Instead of teasing press attendees with pre-show news about General’s latest tool launches, Frampton explained that recent consolidation efforts would make this show’s new offerings slim.

That’s wasn’t a level of candor I expected to hear from a leading machinery vendor, going into the biggest trade show of the year. Typically, AWFS is an opportunity for companies to fan their tail feathers and demonstrate new product as a sign of lively growth. But General’s admission pointed to wellbeing of a different sort: sometimes you have to cull inventory and reassess in order to focus resources where they are needed most.

“At some point or another every company has to go through this type of exercise,” Frampton says. “To give you an idea, we went from a 186-page catalog in 2013 to a 176-page catalog in 2015.”

But those 10 pages’ worth of discontinued tools and products aren’t, for Montreal-based General, an indication of storm clouds on the horizon. Quite the contrary, in fact.

Instead, Frampton says that consolidation over the past 18 months or so has been a gradual process with the goal of analyzing what customers really want. Older, lower-demand models have been discontinued in order to make room for upgraded, higher-volume products.

“For example, having four 6-in. jointers in the lineup didn’t make sense if only two of them were in steady demand,” Frampton says. “I wouldn’t call it a post-recession effort as much as just good business.”

Even though some SKUs in General’s product catalog have gone away, Frampton reports that there are growth opportunities within several of the “traditional” categories of woodworking machinery these days. The company has expanded its drill press and band saw line, and it has made some additions to its Excalibur router table product family. (To see an AWFS video about a new Excalibur router table package, click here.)

Another effort to adjust its stationary machinery business happened about three years ago, when the company closed its Drummondville, Quebec, foundry. The facility manufactured a full line of General-branded, Canadian-made woodworking tools. Those products paralleled the “General International” family of machines to some extent, which are made in the Pacific Rim. Frampton says that while there was some negative reaction to the foundry closure, “the vast majority of customers understood the decision.”

“We carried on as long as we could (with the Drummondville operation), which was way longer than anyone else in North America did for a full line of products. But from a business point of view, inefficient manufacturing processes, making low-volume, high-cost products that were decreasing in demand made it a very simple decision.”

While new drill presses and band saws are filling some of the shelf space opened up by consolidation efforts, Frampton says the company is also experiencing a big demand for CNC. Frampton speculates that it points in part to a shrinking Baby Boomer woodworking market, which typically wants more traditional tools.

“Many new users are younger and more tech-savvy, hence the big interest in CNC.”

Within the CNC category, Frampton says the demand is for smaller-sized and affordable systems that appeal to home users for their hobby projects. Schools are jumping on board the CNC train, too.

“The education market certainly seems to be re-energized and has come back with more of a bent towards teaching and preparing the next generation of woodworkers for that new technology,” Frampton says.

Consolidation on the product side of General International’s business was only part of Frampton’s pre-AWFS news. The second big announcement involved the company’s recent addition of 45,000 square feet to its Murfreesboro, Tennessee, distribution center. That ribbon cutting brings General’s total North American warehouse space to around 140,000 square feet. It quintuples Murfreesboro’s original 12,000 square feet from when it opened five and a half years ago.

“We also have an option to add up to an additional 30,000 square feet whenever we’re ready for it.”

Regarding its only U.S. distribution point, Frampton says Murfreesboro can deliver product to around 75 percent of General’s stateside distributor network within three days. That network is extensive, Frampton says. “We deal with pretty much every major independent brick-and-mortar retailer in North America, as well as most of the larger industrial supply houses, multi-location retailers and some major online tool retailers.”

General is also strategizing how it can service its clientele even more efficiently in the future. While Frampton couldn’t share specifics at this time, the company hopes to have more distribution announcements to make in the next 18 to 24 months.

These recent consolidation and expansion efforts are creating exciting times, Frampton admits. “We look forward to maintaining our position as a leader in the Canadian (woodworking) market and we’re working harder than ever to expand our market penetration in the U.S.”

Learn more about General International by clicking here.